All Categories

Featured

Table of Contents

- – Eye And Dental Insurance For Seniors Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Medicare Dental Insurance For Seniors Santa An...

- – Low Cost Dental Services For Seniors Without I...

- – Low Cost Dental Services For Seniors Without ...

- – Medicare Dental Insurance For Seniors Santa A...

- – Dental Insurance For Seniors With No Waiting...

- – Dental Insurance Seniors Santa Ana, CA

- – Delta Dental Insurance For Seniors Santa Ana...

- – Medicare Advantage Plans Near Me Santa Ana, CA

- – Vision And Dental Insurance For Seniors Sant...

- – Medicare Providers Near Me Santa Ana, CA

- – Hearing Insurance For Seniors Santa Ana, CA

- – Harmony SoCal Insurance Services

Eye And Dental Insurance For Seniors Santa Ana, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

If you are covered under two oral advantages plans, tell the manager or carrier of your primary strategy concerning your dual coverage standing. Sometimes, you might be assured complete insurance coverage, where plan benefits overlap and you obtain a gain from one plan where the various other strategy details an exclusion.

By doing so, you can obtain the care that's best for you and deal with the dentist to establish therapy plans that give the most and first-rate treatment. Your dentist can't respond to certain inquiries regarding your oral insurance plan or anticipate what level of protection for a certain treatment will certainly be.

Medicare Dental Insurance For Seniors Santa Ana, CA

What your oral insurance policy will cover depends on the type of plan you pick and the timing of dental care and treatments. PPO strategies are the most prominent kind of dental strategy in Florida.

You will still pay component of the cost for other oral care services for youngsters. Adults can include dental protection to a Covered The golden state health and wellness strategy for an additional expense. Oral implants can be costly, with the expense of a single tooth implant varying from $3,100 to $5,000. Coverage for implants depends on the strategy you select.

Out-of-network carriers will set you back more, whether you're obtaining preventative dental treatment or significant dental job. This plan has an annual $50 insurance deductible and the highest possible maximum benefit of every one of Aetna Dental Direct intends, with an annual cap of $1,250. (The annual cap for out-of-network benefits is a little reduced: $1,000.) Delta Dental prepares typically have $50 yearly deductibles.

Low Cost Dental Services For Seniors Without Insurance Santa Ana, CA

But if your oral health is typically great and you prefer to save a few dollars on a monthly basis (which can amount to $60 or $70 annually, depending on your place and age), the Core PPO plan might fit your demands. Elders on a budget plan can choose this strategy that offers preventative care only for about half the regular monthly price of Aetna's other PPO oral strategies.

Comparable to Aetna's various other PPO plans, there's no deductible to pay prior to you can obtain preventive oral care. This strategy may be an excellent option if you don't foresee significant dental costs in the future or if you're able to cover major oral expenditures that could show up. Those who 'd favor saving cash now and taking their possibilities that they won't require major dental work could be a great suitable for this simple preventive treatment plan.

Low Cost Dental Services For Seniors Without Insurance Santa Ana, CA

Aetna's Important Cost savings Rx program has 68,000 getting involved pharmacies, and the card makes it possible for holders to save as high as 60 percent off of generic drugs and 12 percent off of brand-name medicines. Registering is easy. You can get the card by joining online, publishing out a type and mailing it in, or contacting us to obtain the discount card over the phone.

Lots of older Americans are losing out on oral insurance coverage because not all Medicare and Medigap programs cover oral. To ensure you have accessibility to the dental coverage you require, a supplemental oral benefits plan can offer those critical dental advantages that your Medicare or medical insurance strategies might not cover.

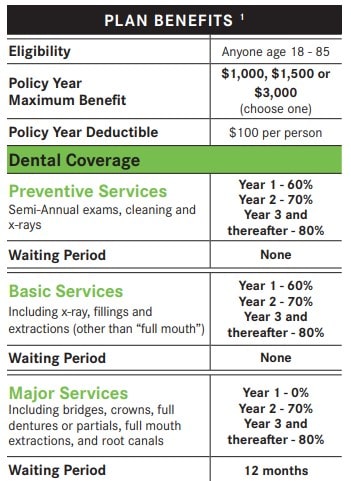

Please reference the full policy for full information. As noted, the Ascent Strategy has no waiting duration. Additionally, services subject to waiting durations vary relying on the strategy. is a government program run by a branch of the united state Division of Health And Wellness & Human Solutions. It is offered to the majority of people aged 65 or older, younger people with disabilities, and individuals with End Phase Kidney Condition.

Medicare Dental Insurance For Seniors Santa Ana, CA

Wondering if you certify for Medicare?

* These are benefit highlights only. Regular monthly costs revealed are instances only of our most affordable regular monthly rates for family members protection (subscriber & partner, ages 65+). Actual rates differ based upon strategy selection, your age, your area, number of individuals guaranteed, their age, and relationship to you. Waiting durations might be waived if you had qualifying oral protection prior to enlisting.

86% of grownups agree that having dental insurance policy is necessary to protecting oral and overall health and wellness. 85% of grownups really feel that oral insurance coverage deserves the cost and assists in saving them money in the future. This emphasis on cost-savings and preventative treatment is why all Delta Dental of Illinois private strategies cover preventative appointments and cleanings at 100% and aid decrease out-of-pocket expenses for many procedures by sharing the expense with you.

That's why we provide multiple strategy levels, so you can make the appropriate option based on your individual requirements and spending plan. Our most thorough strategy with the wealthiest coverage, this strategy covers most oral procedures (and has the highest possible yearly optimum). This strategy provides 100% precautionary coverage and provides coverage for teeth lightening, implants, and mouthguards.

Dental Insurance For Seniors With No Waiting Period Santa Ana, CA

Delta Dental of Illinois private oral strategies vary in monthly costs prices, insurance deductible, and the quantity covered for specific treatments. Plus, our dental strategies provide extensive coverage with reduced deductibles and no registration charge. Santa Ana Best Insurance For Seniors. If you want protection, get a quote today and keep your smile solid!

Financial savings from enlisting in the MetLife Federal Dental Plan will rely on various aspects, consisting of the expense of the strategy, how typically individuals go to the dental practitioner and the price of solutions rendered. 7 Based upon MetLife information for a crown (D2740) in postal code 06340. This instance is utilized for informational purposes only.

In particular states, availability of the private oral product is subject to regulatory authorization. Like many insurance policy plans, insurance policy plans supplied by MetLife and its associates consist of particular exemptions, exceptions, decreases, limitations, waiting durations and terms for maintaining them in force.

With 6.67/ 10 factors, MetLife rates in third area. It is the only firm with an A+ ranking from AM Finest, making it second just to Guardian (A++). It is 3rd best in the Ton of money 500 ratings with a position of 46. Started in 1868, this company is the 4th earliest company we reviewed.

Dental Insurance Seniors Santa Ana, CA

This is one of three firms that uses two strategy kinds, as opposed to the four strategies that just supply PPOs. MetLife has both PPOs and HMOs.

This firm's waiting periods are average- 6 months for basic services and one year for major services. You may be able to miss the waiting periods if you have had "equivalent oral insurance coverage" for twelve month or more and can prove that you are currently covered. In first area with 10/10, MetLife carried out best in this metric.

The MetLife Price cut Dental Program provides 5%-50% off oral procedures, depending on the item and workplace. Currently, the strategy is not offered in Washington, Utah, or Vermont.

In MetLife's instance, these rewards consist of price cuts on eye tests, frames, lenses, and LASIK treatments. MetLife's discount program had the most affordable expense on our listing, with a yearly costs of $211 for a bachelor. Clients can decide to pay month-to-month, quarterly, semiannually, or annually, and the cost is the very same regardless.

Delta Dental Insurance For Seniors Santa Ana, CA

Oral Discount plans are used in collaboration with the 3rd parties Careington International Corporation and VSP. MetLife is best understood for its team (employment-based) benefits, so it maintains details on its individual plans on a different web site called the "MetLife Takealong" web site. This brand is just one of a couple of that does not ask regarding age when computing premiums, so older seniors may have a mild cost benefit.

Humana rated reduced in various other core metrics, and its least expensive score was 2/10 on Insurance Alternatives due to limited choices (Santa Ana Best Insurance For Seniors). Ranking in 5th area, Humana's rating was 3.34/ 10. Of the firms we evaluated, Humana had the ideal J.D. Power's Dental Insurance Consumer Complete satisfaction score with 793/1,000 (the highest possible firm in that survey racked up 810)

Online, it seems the cheapest yearly price for Humana's oral coverage options comes to $216 per year. Those interested in Humana's price cut strategy ought to note that repayments can just be made regular monthly and that it is currently not provided in 7 states.

A full list of Humana Entities can be discovered on Humana's very own site. You can buy Humana plans with the Humana site itself or with some online insurance policy brokers. Quote devices on sites will typically ask you for your age and the state you stay in, though some broker websites may request added details.

Medicare Advantage Plans Near Me Santa Ana, CA

Senior citizens shopping Humana should realize that this business's plan accessibility differs greatly by state more than is ordinary for various other firms. Most of the states do have a dental price cut plan, however 7 states do not, and the internet site merely notes the 43 states that do. Many states only have a couple of plan alternatives, though Humana's full oral insurance product directory includes 3 insurance options plus a dental discount strategy.

As a very well-established firm in the industry, Cigna attained 1st area for Firm Reputation and Reliability. This company had a sensibly solid displaying in PPO Expenses and Insurance Coverage Alternatives, yet it failed in Plan Selection, where it came in last. Cigna placed in starting point for Credibility and Reliability, racking up 10/10 factors.

You'll require to have been covered for a full year by another strategy if you want to certify for the waiver, and other limitations may use. Cigna rated tied in second area with 8/10 factors for PPO Prices. This business's main rates concern is that it does not use strategies through broker sites, and its own quote tool makes it rather challenging to obtain a personalized quote.

Vision And Dental Insurance For Seniors Santa Ana, CA

Its "Dental Savings Program" leaves out an unusually a great deal of states, consisting of the following: Alaska, The Golden State, Montana, North Dakota, Oklahoma, Rhode Island, South Dakota, Utah, Vermont, and Washington. In protected states, seniors can pick from 3 different price cut choices. There's a fundamental option that includes just oral price cuts, or they can pay more for the "household" version that has increased benefits on everything from prescriptions to leisure activities.

Its quote tool makes it show up as if those that have an interest in finding out more about costs require to provide contact info and wait to be called by an agent. This is actually not real senior citizens can leave call fields blank and still see a tailored quote. Know that Cigna quotes are not available on broker websites.

Medicare Providers Near Me Santa Ana, CA

Online, it seems the lowest yearly price for Humana's oral protection options comes to $216 per year. Those interested in Humana's discount rate plan should keep in mind that settlements can just be made month-to-month and that it is currently not supplied in 7 states.

A total checklist of Humana Entities can be located on Humana's very own website. You can look for Humana plans via the Humana website itself or through some on-line insurance brokers. Quote tools on web sites will typically ask you for your age and the state you stay in, though some broker sites may ask for added info.

Seniors going shopping Humana needs to be mindful that this company's strategy accessibility varies substantially by state a lot more than is typical for various other companies. Most of the states do have a dental price cut strategy, but 7 states do not, and the site just details the 43 states that do. Lots of states just have a couple of plan alternatives, though Humana's full oral insurance policy item magazine consists of 3 insurance choices plus a dental discount plan.

As a very reputable business in the industry, Cigna achieved 1st area for Firm Online reputation and Dependability. This business had a fairly solid showing in PPO Prices and Insurance Alternatives, but it faltered in Plan Variety, where it came in last. Cigna placed in starting point for Reputation and Reliability, racking up 10/10 factors.

Hearing Insurance For Seniors Santa Ana, CA

You'll require to have actually been covered for a complete year by an additional strategy if you want to receive the waiver, and other limitations might apply. Cigna placed tied in 2nd place with 8/10 factors for PPO Prices. This company's primary pricing problem is that it does not provide strategies through broker sites, and its own quote device makes it rather challenging to obtain an individualized quote.

Its "Dental Cost savings Program" leaves out an uncommonly multitude of states, consisting of the following: Alaska, The Golden State, Montana, North Dakota, Oklahoma, Rhode Island, South Dakota, Utah, Vermont, and Washington. In covered states, elders can pick from three different discount rate choices. There's a standard choice that consists of simply oral discounts, or they can pay more for the "household" variation that has increased advantages on everything from prescriptions to recreational tasks.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Its quote tool makes it show up as if those who have an interest in learning even more regarding expenses require to give get in touch with information and wait to be called by an agent. This is actually not real elders can leave contact areas blank and still see a tailored quote. Know that Cigna quotes are not available on broker sites.

Santa Ana, CASanta Ana, CA

Santa Ana, CA

Near You Seo Marketing Company Santa Ana, CA

Find Seo Service Santa Ana, CA

Harmony SoCal Insurance Services

Table of Contents

- – Eye And Dental Insurance For Seniors Santa Ana, CA

- – Harmony SoCal Insurance Services

- – Medicare Dental Insurance For Seniors Santa An...

- – Low Cost Dental Services For Seniors Without I...

- – Low Cost Dental Services For Seniors Without ...

- – Medicare Dental Insurance For Seniors Santa A...

- – Dental Insurance For Seniors With No Waiting...

- – Dental Insurance Seniors Santa Ana, CA

- – Delta Dental Insurance For Seniors Santa Ana...

- – Medicare Advantage Plans Near Me Santa Ana, CA

- – Vision And Dental Insurance For Seniors Sant...

- – Medicare Providers Near Me Santa Ana, CA

- – Hearing Insurance For Seniors Santa Ana, CA

- – Harmony SoCal Insurance Services

Latest Posts

Plumbing. Companies Near Me Leucadia

Graduation Photographer Near Me Villa Park

Anaheim Wedding Elopement Photographer

More

Latest Posts

Plumbing. Companies Near Me Leucadia

Graduation Photographer Near Me Villa Park

Anaheim Wedding Elopement Photographer